Annual depreciation expense calculator

Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset. Annual straight line depreciation of the asset will be calculated as follows.

Straight Line Depreciation Formula And Calculator

For an asset with a five-year useful life you would use 15 as the denominator 1 2 3 4 5.

. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation Expense is calculated using the formula given below Depreciation Expense Fixed Assets Cost Salvage Value Useful Life Span Depreciation Expense 5000 3000 5. The IRS also allows calculation of depreciation through table factors listed in Publication 946 linked below.

This calculator shows how much an asset will depreciate. One way to calculate depreciation is to spread the cost of an asset evenly over its useful life. This is called straight line depreciation.

Calculate the annual depreciation at 16 per year over five years on new equipment which was purchased at R180 000 cost price by using the reducing balance method. Here 700 is an annual depreciation expense. Divide step 2 by step 3.

Percentage Declining Balance Depreciation Calculator. To use a home depreciation calculator correctly you must first identify three fundamental indicators. Depreciation expense 4500-1000 5 700.

Simply divide the assetÕs basis by its useful life to find the annual depreciation. Periodic Depreciation Expense Fair Value Residual Value Useful life of Asset For example Company A purchases a building for 50000000 to be used over 25 years with. The propertys basis the duration of recovery and the method in which you will.

To convert this from annual to monthly depreciation divide this result by 12. Sum-of-the-years-digits SYD Method The method that takes an assets expected life and adds. First one can choose the straight line method of.

Straight Line Asset Depreciation Calculator Enter the purchase price of a. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of.

For example if you have an asset. It provides a couple different methods of depreciation. Periodic straight line depreciation Asset cost - Salvage value Useful life.

This calculator calculates depreciation by a formula. Depreciation Expense 2 x. Annual Depreciation Expense 2 x Cost of an asset Salvage ValueUseful life of an asset Or The double declining balance depreciation expense formula is.

80000 5 years 16000 annual depreciation amount Therefore Company A would depreciate the machine at the amount of 16000. Straight-line depreciation is the easiest method to calculate. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Depreciation Expense Asset Cost - Residual Value Useful Life in Units of Production Units Produced Double Declining Balance Method Formula Depreciation Cost Formula 2 Rate of. In the first year multiply the assets cost basis by 515 to find the annual.

Depreciation Calculator

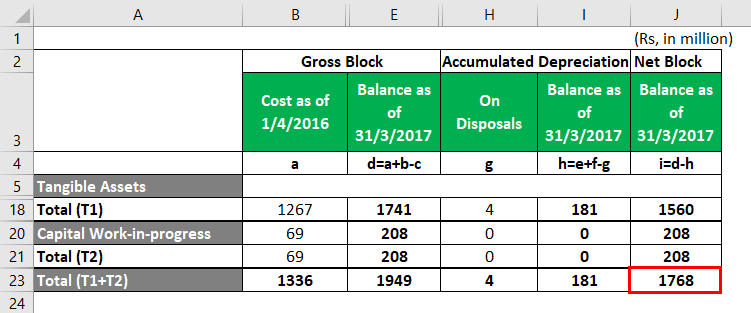

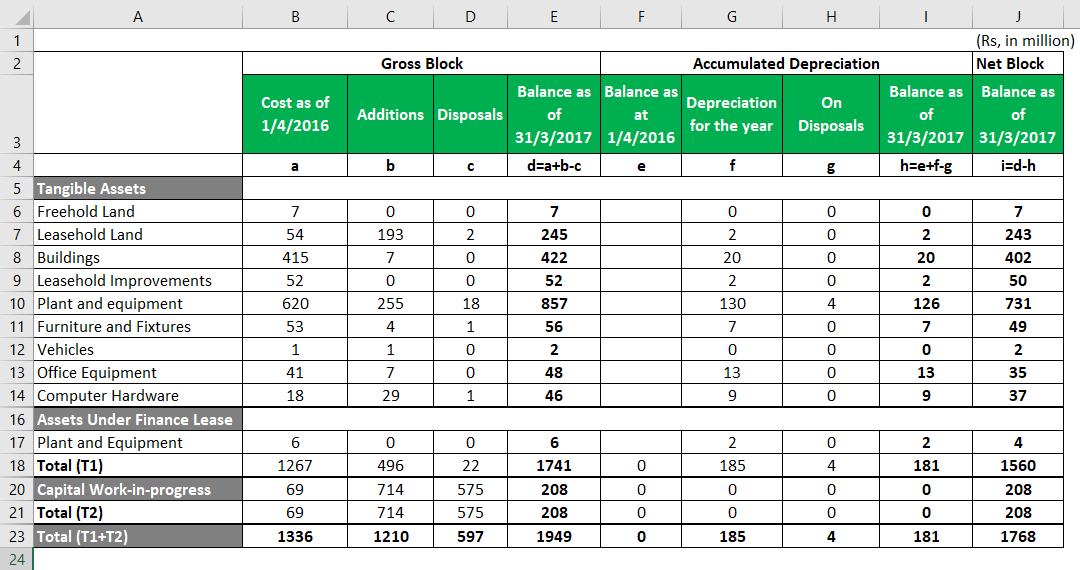

Accumulated Depreciation Formula Calculator With Excel Template

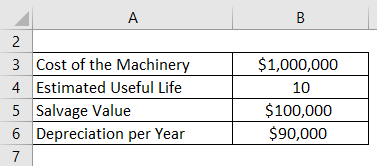

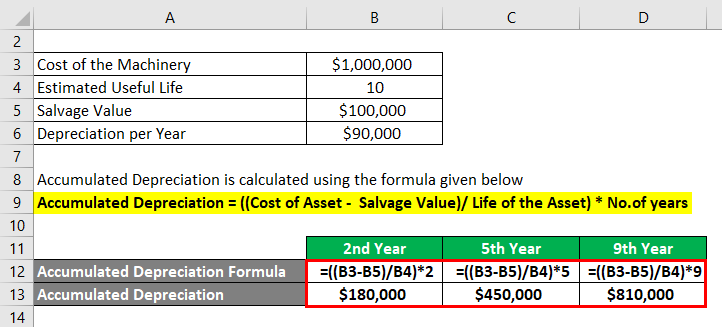

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

How To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template

Double Declining Balance Depreciation Calculator

Depreciation Formula Examples With Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Calculation

Declining Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template